If you’re in the market for a new home, exploring various mortgage options is essential. Among the choices, 40-year mortgages offer unique features that might align with your financial goals. Let’s take a closer look at this lesser-known option to help you make an informed decision.

About 40-Year Mortgages

A 40-year mortgage is a long-term loan with a repayment period extending over four decades. This extended timeframe allows for lower monthly payments versus the more traditional mortgage terms. While not as common as 15- or 30-year mortgages, 40-year mortgages can be a viable option for certain buyers. Typically, these loans come with fixed or adjustable interest rates, much like their shorter-term counterparts.

Benefits for Homebuyers

The primary advantage of a 40-year mortgage is the lowered monthly payment, which can significantly ease the financial burden for some homeowners. Lower payments may also enable buyers to afford a more expensive home than they could with a shorter-term loan. For those focused on cash flow and budgeting, this mortgage option gives more financial flexibility, particularly for those who anticipate income growth over time.

Moreover, opting for a 40-year mortgage might help you maintain a healthier debt-to-income ratio. This can be beneficial when managing other financial responsibilities, such as student loans or setting up a retirement fund.

Differences Between 15- and 30-Year Mortgages

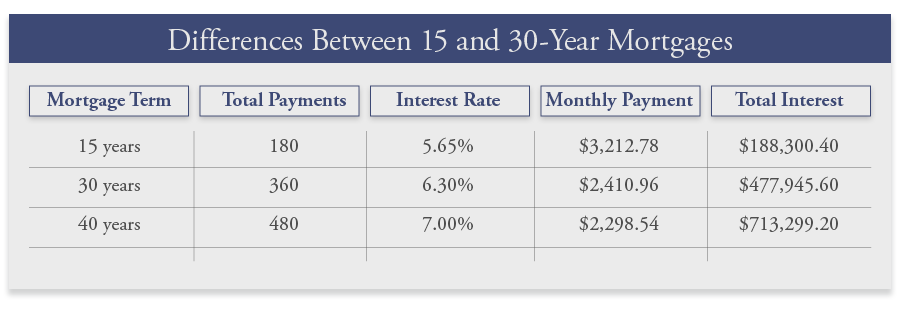

While a 40-year mortgage offers lower monthly payments, it’s essential to understand the trade-offs. Compared to 15- or 30-year mortgages, you’ll pay more in interest over the life of the loan. Shorter-term mortgages, like the 15-year option, mean higher monthly payments but less interest paid overall. They also build equity faster, which can be advantageous if you plan to sell or refinance in the future.

Below is a table illustrating the difference in interest on a 15-year, 30-year and 40-year mortgage based on a $390,000 loan principle, using recent average interest rates as an example:

As you can see, the longer the mortgage term, the more interest you’ll pay over time. It’s crucial to consider how this affects your overall financial picture.

Expert Insights

Financial expert Dave Ramsey advises caution when considering extended mortgage terms, such as the 50-year mortgage. Although he hasn’t specifically commented on the 40-year term, his general guidance emphasizes the importance of building equity quickly and minimizing interest costs. Ramsey typically recommends shorter mortgage terms to achieve financial independence faster.

Summary

Choosing a 40-year mortgage requires careful consideration of your financial situation and long-term goals. While it offers lower monthly payments, it comes with higher interest costs over time. Working with a knowledgeable realtor and lender can help you weigh these factors and navigate the home-buying process smoothly.

For more insights into mortgages and other topics, read our blogs. And if you don’t know where to look for a lender, start with Ryan’s helpful contacts. Then, contact Ryan Roberts to begin your real estate journey with confidence, whether you’re looking to list your home, buy a new one, or both.